Introduction

Much has been written and said about the challenges facing the Biotech/Pharma industry. How and where will innovation come from? How do you control the increasing cost of drug development? The impact of healthcare reform? What is the value and impact of globalization on R&D efforts? Consolidation within Biotech/Pharma and CROs. Emerging from some of these story lines is the exciting opportunities for enabling drug development in China and India. Both countries have represented a vast and growing arena for commercial and manufacturing in the pharmaceutical industry for some time now. More recently, these countries are also representing untapped opportunities for enabling Research and Development through Contract Research Organizations (CROs) as cost and access to talent, technologies, and clinical sites continues to be a challenge to the industry. India, in particular, represents an emerging and compelling story. R&D and innovation in the pharmaceutical industry are usually not the first thoughts associated when one thinks of India. In fact, since the early 1970s, the pharmaceutical Industry in India has been manufacturing centric and dominated by the development of low-cost, generic products – it has been a thriving generics, formulation, and bulk drug industry. Over the last 10 – 15 years, there has been a very slow but noticeable shift to include the discovery and development of drugs since India agreed to uphold the Trade-Related Intellectual Property Rights in 1995 and amended legislation in 2005 to recognize and enforce product patents in all fields for technology including pharmaceuticals. Yet India is still an emerging player in terms of enabling drug discovery and development through contract services, in particular for biologics.

So what would we like to expect from Indian CROs in the next 10 years? If one examines the IT outsourcing story in India, the potential is quite exciting. India was the base for a lot of early help desk, back office services, low-cost outsourcing for a lot of IT companies, including HP, Dell, GE to name a few; today, these companies have major R&D centers in India for the development of new, innovative products. The journey in IT was filled with many twists and turns, false starts, infrastructure challenges, and significant oversight and overhead yet the result has been an unprecedented access to talent and capabilities that are driving innovation for these technology companies. The same compelling attractions are available to the pharmaceutical industry: a large, English speaking, cost-effective workforce with advanced degrees in the sciences, medicine and IT coupled with a strong entrepreneurial spirit, situated in the largest democracy in the world.

This article will focus on defining the need further and detailing what we believe are the potential areas of opportunity to support global R&D through contract services in India.

The Need: Contract Services to Support R&D of Drugs and Biologics

Given India’s strong knowledge of small molecule manufacturing and synthetic chemistry, can any of this expertise translate to the support of R&D, and in particular, that of biologics?

In order to answer this question, it is important to understand what is similar and different in the development of small molecules and biologics. Many of the drug development steps are the same. The discovery aspects are related to good target biology and lead optimization to identify candidate molecules. Early development focuses on testing in the appropriate non-clinical species to demonstrate efficacy and safety, conducting IND enabling studies under GLP conditions. Clinical development involves conducting the appropriate early studies to demonstrate tolerability, pharmacokinetics and some evidence of hitting the target followed by Phase II proof-of-concept studies and large Phase III safety and pivotal trials. Registration and Commercialization has the same customers – health authorities, payers, and most importantly, patients.

In order to answer this question, it is important to understand what is similar and different in the development of small molecules and biologics. Many of the drug development steps are the same. The discovery aspects are related to good target biology and lead optimization to identify candidate molecules. Early development focuses on testing in the appropriate non-clinical species to demonstrate efficacy and safety, conducting IND enabling studies under GLP conditions. Clinical development involves conducting the appropriate early studies to demonstrate tolerability, pharmacokinetics and some evidence of hitting the target followed by Phase II proof-of-concept studies and large Phase III safety and pivotal trials. Registration and Commercialization has the same customers – health authorities, payers, and most importantly, patients.

However, major differences exist in terms of the molecules, their properties and behaviors. Biologics in general are “biologically” generated large molecules as compared to synthetic small molecules (traditional pharmaceuticals). Table 1 illustrates the differences in the properties of biologics and small molecules and the inherent challenges in the development of both of these modalities.

Given these properties it is important to note that biologics have several real benefits and some unique challenges:

- Wider therapeutic indices (good for treating chronic diseases)

- Less non-specific toxicities (due to their targeted nature)

- More predictable safety profiles

- More predictable pharmacokinetics and PK/PD can be used to help dosing

- Less frequent dosing: which is great for chronic dosing situations

- No concern for drug-drug interactions due to CYP450 metabolizing enzymes

These benefits also bring with them some unique challenges:

- IV/SC dosing as compared to oral: more difficult and requires specialized handling

- Long half-life implies longer washout times for drug in the body

- Dose can impact cost of goods

- Process development is complex and difficult

- Immunogenicity concerns always exist

To become a real player in the CRO market in the area of R&D, emerging Indian CROs have to develop expertise in both understanding the complexities of these molecules and being able to conduct discovery and development studies (in-vivo studies, bioanalytical assays, GLP studies, etc.) while also understanding how the properties of biologics and small molecules will require different expertise, capabilities, and technologies for the conduct of these non-clinical studies.

Potential Areas of Opportunity for India

To appreciate the tremendous opportunity India has to ultimately become a global leader in preclinical and clinical services, one has to only look at the significant shift happening in the Indian domestic pharmaceutical market. Several key regions in India are developing hubs for R&D in drug development most notably in Bangalore and Hyderabad, both of which are homes to domestic and global companies. The domestic companies have actively hired leaders with extensive drug development experience in global environments and are positioning themselves to develop novel molecules, in addition to partnering with top pharmaceutical companies like Merck, Pfizer, Amgen, etc. It is this emerging culture of discovery and innovation in drug discovery that could fuel the growth of the nascent preclinical CRO business in India.

To appreciate the tremendous opportunity India has to ultimately become a global leader in preclinical and clinical services, one has to only look at the significant shift happening in the Indian domestic pharmaceutical market. Several key regions in India are developing hubs for R&D in drug development most notably in Bangalore and Hyderabad, both of which are homes to domestic and global companies. The domestic companies have actively hired leaders with extensive drug development experience in global environments and are positioning themselves to develop novel molecules, in addition to partnering with top pharmaceutical companies like Merck, Pfizer, Amgen, etc. It is this emerging culture of discovery and innovation in drug discovery that could fuel the growth of the nascent preclinical CRO business in India.

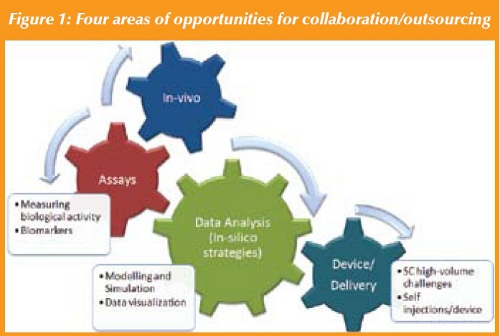

There are four general categories in which Indian CROs can begin to develop capabilities that will further the preclinical development of biologics (See Figure 1 below):

1. In-vivo studies

2. Assays

3. Device/delivery capabilities

4. Data Analysis (In-silico strategies)

In-vivo studies: Indian CROs are well behind their global competitors including CROs in China when it comes to building GLP/world-class, invivo facilities development. Several emerging CROs have demonstrated both the breadth and depth to support such work, including core DMPK and Pathology labs, with world-class capabilities, technology, and people; purpose-built facilities that can support the discovery and development of small molecules. There is still a lot of cultural, regulatory, and infrastructure change required and China is clearly becoming an emerging leader in this regard. The type of skill sets needed for this opportunity are very similar for small and large molecules. Although these are significant barriers to entry and competitiveness, there are other areas where Indian CROs can and should compete to develop technologies and competencies including areas of assay development, device and delivery, and in-silico technologies (See Figure 2).

Assays: Measuring biological activity and drug exposure is critical for the development of biologics (as it is for small molecules) spanning the spectrum from Discovery to Clinical. This includes the development of assays to measure drug levels, immunogenicity (anti-drug antibody levels), and biomarkers. The assays used for measuring drug or anti-drug antibody levels are very different from traditional LC/MS/MS assays used for small biomarkers of activity. Unlike the in-vivo challenge, this is inherently a challenge of developing skill sets at the academic institutions that support the sciences and medical community and a focus by the government in streamlining the immigration process to allow the hiring of talented leaders and scientific innovators from abroad. The former will build the long-term solution and latter the short-term platform for growth.

Device and Delivery capabilities: Biologics, due to their size and properties, also have unique delivery challenges, those being primarily delivered intravenously or subcutaneously either on a weekly, bi-weekly, monthly or quarterly basis. Given the chronic nature of the diseases treated the need to find methods to deliver biologics safely, conveniently and less frequently always exists. Additionally self-injection of biologics is an important facet where development of auto-injection devices may be an area where India can leverage its engineering skill set to help the industry.

Data analysis/In-silico efforts: The final area of opportunity builds on the tremendous foundation that has been in place due to India’s leadership position in IT, In-silico strategies. This is a global, untapped potential. There continues to be a significant ethical drive in discovery and preclinical to reduce animal testing and one of the emerging technologies that can support this is the development of powerful Computational Modeling and Simulation capabilities. Additionally, using modeling and simulation to better optimize dosing regimens in clinical development is of huge value. Here the intersection of biology, engineering, and information technology may be India’s greatest opportunity for impact. Developing informatics capabilities to model disease states, target models, etc. has practical utility in discovery research and the clinic. It can especially aid the decision making process thereby reducing costs, increasing success to POC for drugs, and generally reducing the animal use burden while also decreasing molecules. Immunoassay-based platforms are necessary to have the specificity and sensitivity needed to measure levels of drug in plasma or other tissues. Similarly a large variety of assays will be needed to measure patient risk. It is particularly intriguing to see how this area will develop in India as the two major biotechnology hubs; Bangalore and Hyderabad are also the hubs for nanotechnology, engineering, and IT.

Conclusions

The overall potential to enable R&D for the pharmaceutical and biotech industry in India is expansive. However there will need to be a steady increase in the learning and expertise around drugs and biologics in the CRO business in India. The uniqueness of biologic molecules and the unique tools that may be needed to evaluate them will have to be available in these businesses before there is interest in utilizing the expertise.

In summary, there are several opportunities in the areas of CRO services for the biotech industry focusing on in-vivo studies, GLP facilities, bioanalytical services and biomarker analyses, delivery technologies and modeling and simulation capabilities. Some of the important factors that could contribute to the potential growth of this services industry in India are:

- Strengthened legislation to recognize and enforce product patents

- Leveraging of IT experience, the local educated technical experts and scientists coupled with the hiring of globally seasoned drug development leaders

- The significant drive to reduce overall cost of drug development by leveraging a low-cost, highly talented workforce available in India

The confluence of all of these factors is something that emerging R&D Indian CROs must take advantage of if they want to become global leaders and perhaps best exemplifies the excitement of what the next 10 -15 years will bring in the support of global R&D through contract services in India. It also clearly represents the biggest opportunity for global drug development companies, tapping into a large, English speaking, cost-effective workforce with advanced degrees in IT, sciences, and medicine coupled with a strong entrepreneurial spirit, situated in the largest Democracy in the world.

Sara Kenkare-Mitra Ph.D. is currently Vice President of Development Sciences, a translational sciences organization that spans R&D at Genentech. In this role she has the ultimate responsibility for ensuring the successful translation of promising molecule-discoveries from Research into the Development phase. Dr. Kenkare-Mitra joined Genentech in 1998 as a Scientist and was promoted to Associate Director, Small Molecule Pharmacology in 2002. In 2004, she became Director of Pharmacokinetics and Pharmacodynamic Sciences and in 2005, was promoted to Sr. Director. In 2007, she became Vice President of Development Sciences. Sara has a successful track record with development of biotherapeutics and small molecules leading to significant contributions to Genentech’s key product approvals including Avastin, Tarceva, Lucentis, and Xolair. More than 25 Investigational New Drug applications have been filed by her organization with US and ex-US regulatory agencies. Sara has a background in pharmacy (B Pharm, India), a Ph.D. in Pharmaceutical Chemistry from UCSF (focused on Pharmacokinetics and Metabolism) and a post-doctoral fellowship in Clinical Pharmacology from UCSF (in the area of PK/ PD modeling and simulation). She is one of the founding members of the Bay Area ADME society. Dr. Kenkare-Mitra has published a number of scientific publications in the area of PK/PD and drug metabolism and has spoken frequently at society meetings and industry conferences. Sara has a passion for developing therapies to meet significant unmet medical needs with a strong scientific basis and an emphasis on personalized medicine. Sara is also passionate about accelerating the development of therapeutics for addressing a huge unmet medical need in the area of pediatric neurologic disorders.

Ashwin Datt is Director, Development Sciences at Genentech. Leading an integrated Operations group consisting of Outsourcing, Contracts, and Study Operations that manages the logistics, legal, financial, and compliance components of nonclinical outsourced services in support of the entire R&D portfolio. Prior to joining Genentech, Mr. Datt worked at Amgen, Inc in Thousand Oaks, CA as Senior Manager, Research Operations – PKDM where he led the department’s long range planning (LRP) efforts and the strategic planning and functional Operating review process. Additional activities included developing Portfolio and Capacity management tools in partnership with R&D Project Management, leading pre-clinical integration efforts for the Tularik acquisition. Lead business integration efforts for the Kinetix acquisition and lead the development of a model for organizational and functional workforce planning. Mr. Datt began his career as a lab manager at the University of California, Los Angeles, Department of Neuropharmacology in support of research efforts in Parkinson’s and methamphetamine drug abuse. Mr. Datt has over 17 years of lab management, business operations, and human resources experience. He is a certified Change Management Facilitator, Facilitation in Innovation facilitator (DeBono 6 Thinking Hats), and six-sigma green-belt certified. He is a driven change agent with a passion for developing broad organizational and operational strategies but also to drive execution and influence decision making at all levels within the organization. Born in India and living his early years in Afghanistan, Mr. Datt graduated from UCLA with a BA in Psychology.

This article was printed in the July/August 2010 issue of Pharmaceutical Outsourcing, Volume 11, Issue 4. Copyright rests with the publisher. For more information about Pharmaceutical Outsourcing and to read similar articles, visit www.pharmoutsourcing.com and subscribe for free.