The success rates of drugs during various phases of the clinical development pipeline are crucial benchmarks for valuation models in the pharmaceutical investment community [1].

As peptide-based drug developers, we are naturally interested in learning how peptides fare compared with their distant relatives, small molecule and monoclonal antibody therapeutics. But what are exactly peptides? In a recent Jeopardy television game show, peptides were identified as stretches of amino acids. In biochemistry textbooks, peptides are defined as fragments of proteins. But with the expansion of non-natural residues, endcapping, cyclization techniques, and altered monomer assembly bonds, I personally identify peptides as anything that can be constructed on a contemporary peptide synthesizer.

To keep it simple, at the lower end even a dipeptide is a peptide, and at the higher end we usually draw a molecular weight limit at 10,000 Da (roughly 90 non-glycosylated or phosphorylated residues). The picture is less clear from a regulatory standpoint.

Size Matters but is it Enough?

Although the US Food and Drug Administration (FDA) issued draft guidance in 2012, classification of peptides remains subject to interpretation. According to regulatory and development experts at Johnson and Johnson [2]: <40 residues define small molecules (new molecular entities, NME) and >100 residues define protein therapeutics. For those entities that fall within the gray area (40-100 residues), the manufacturing process (chemical/synthetic or recombinant) indicates the “correct” classification.

The Peptide Therapeutics Foundation simplifies the matter. Synthetic peptides of any length, up to 50 residues, are considered peptides regardless of their production method or whether they are conjugated to proteins. This definition does not include recombinant proteins themselves, for example, insulin [3]. Just to remind you, insulin consists of 51 residues, just one above the 50-residue threshold. The exclusion of insulin family members in this classification, and in almost all references, raises eyebrows of peptide synthesis experts. While currently insulin is indeed produced for patient distribution by recombinant DNA techniques, for continuing insulin development on the research scale chemical synthesis is preferred [4]. Since the first successful chemical synthesis of insulin in 1965 in China [5], the technology developed so fast1 that currently very difficult members of the insulin-relaxin family of “peptides” can be produced within weeks, all with outstanding purity and production yields [6]. Add to this mix chemical ligation that enables the reproducible preparation of protein molecules of a size that even 20 years ago was considered to be inaccessible by chemical methods [7].

Delivery Method Counts, Too

From another perspective, some pharmaceutical and investment firms consider peptides as a class of biologics because oral activity is rare among them. This coincides with the notion of peptides as biologics (Part 21 CFR 9601.2, FDA), regardless of production route, primarily due to the need for parenteral administration [8]. Finally, a report from where many clinical success rate data will be cited (vide supra) lists two datasets: 1) the FDA classification that distinguishes small molecules from biologics, and non-NME formulations (novel presentation of approved products), and 2) the BioMedTracker product categories that separate NMEs, monoclonal antibodies, proteins/peptides, and vaccines [1]. Eliminating small molecules and monoclonal antibody therapeutics, the protein/peptide category is likely the most realistic representation of the development success rate of peptide therapeutics.

Now that we have the classification defined, other factors come into play.

Confounding Factors

Even if we successfully define and identify peptide drugs, three extrinsic variables make success rate quantitation difficult at best.

Data Period

The year 2012 was big for peptide drugs. According to a biotechnology report [9], of the 40 approved drugs that year, 5 (12.5%) were peptides.2 However, in the Protein Therapeutics report mentioned earlier, the number of peptide approvals between 2001 and 2012 totaled 19. Due to the low figure of drug approvals in general and peptide approvals in particular, the success rate is dramatically different if we consider the data acquisition period ending in 2011, add one more year, or look only at the more recent 2013 data.

Therapeutic Area

Not all therapy areas are created equal, at least not from a regulatory point of view [10]. Systemic anti-infective drugs gain marketing approval (24%) nearly three times more frequently than cardiovascular medications (9%), or drugs acting on the central nervous system (8%). Considering the extensive research on antimicrobial peptides, this trend may bolster the relative success rate of peptide approval, although Dr. Waleed Danho at the European Peptide Symposium in Helsinki (2008) predicted that that next peptide blockbuster would come from CNS research.

Discussion of therapeutic area would not be complete without addressing oncology. This is the most extensive and well-funded area of research. Although small molecules are approved at a slightly higher rate than peptides and other “large molecules” (14% vs 11%) [11], there are also considerably more abundant candidates in the former category.

Corporate Focus

Large molecule compounds, including peptides, comprise a minority (15%) of all drugs developed by the 50 largest pharmaceutical firms. Yet this is where most statistical drug success data originates [10]. Even more confounding is the fact that these compounds are much more typically antibodies rather than peptides.

Moreover, when a company has the resources to develop an additional or alternative indication for a drug, overall clinical success rate increases. In fact, the improved success rates are predictable. Second indication approvals increase 3% for NMEs, 7% for biologics, and 10% for non-NME drugs [12]. While smaller biotechnology firms cannot always afford carrying multiple indications for peptides, Xoma did pursue multiple trials with its antibacterial peptide, a fragment of the bactericidal/ permeability increasing protein, or BPI [13].

Peptides are attractive for orphan drug indications or in diseases where traditional drug discovery process fails to provide appropriate candidates. For example, in 2010 tesamorelin was approved by the FDA at a margin of 16-0 for the treatment of HIV-treatment associated lipodystrophy, in spite of serious concerns of side effects. The clinical trial participants even testified about the benefits of the drug [14].

Relative Success Rates

Oncology paints the picture of small NMEs brighter than the numbers would indicate. Less than 8% of those entering Phase I clinical trials, across all indications, will make it to market compared to a large molecule success rate of 13% [1].

As a category, large molecules exhibit consistently higher success rates, in all clinical phases, compared to small molecule NMEs [10] (see Table 1).

Table 1. 2010 Successful Progression Rates [10]

As discussed earlier, large molecules cover a broad territory. But interestingly, the promise of today’s favored monoclonal antibody therapeutics equates to only a slightly higher success rate than that of peptides and non-antibody proteins.

On closer analysis, The Peptide Therapeutics Foundation reported a 23-26% overall success rate of peptides entering clinical trials between 1984 and 2000 [15]. In this dataset, a total of 54 therapeutic peptides were approved by at least one regulatory agency.3

According to the most recent report, the overall success rate of all drugs entering clinical trials is 10.4% [1].

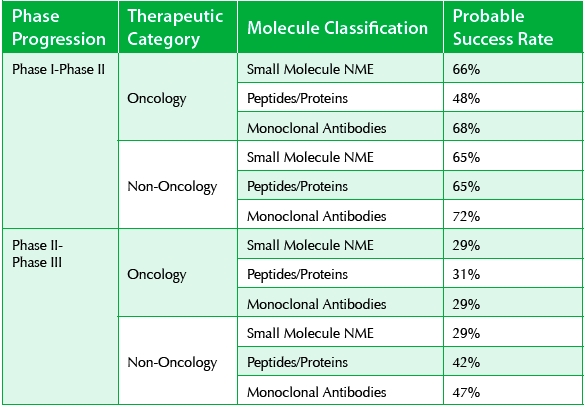

In this dataset, 66% and 65% NMEs proceed from Phase I to Phase II in oncology and non-oncology applications, respectively. These figures are 48% and 65% for peptides/proteins and 68% and 72% for monoclonal antibodies. Interestingly peptides/proteins outperform small molecules at the Phase II-Phase III transition stage with 29% for NMEs (both oncology and everything else), and 31% and 42% for peptides/proteins. While peptides are considered safe drugs in Phase I clinical trials, up to this point they were considered vulnerable in Phase II when efficacy comes into the picture. My previous article, “Peptide-based Drug Discovery & Development, Common Misconceptions,” [16] offers a more thorough discussion of these issues.

It is pleasing to see that peptides are more efficacious in later stage clinical trials than we originally thought. On average, antibodies perform similar to peptides (29% and 47% in oncology and non-oncology applications, respectively) in Phase II-Phase III transition (see Table 2).

Table 2. 2013 Successful Progression Rates [1]

Even more encouraging, peptides and proteins continue to achieve high success rates following Phase III trials. In the non-oncology group alone, 64% proceed to New Drug Application status and from these 93% receive new drug approval for one or more indications.

Given all the available data, it is clear that non-oncology peptides and proteins represent the highest success rates among all drug classes in Phase III clinical trials and beyond.

Footnotes

1 Research led by Professor John Wade at the peptide group at the Florey Neurosciences Institutes (Melbourne, Australia).

2 28 small molecules, 2 monoclonal antibodies, 3 enzymes, a cell-based drug, and a vaccine.

3 Four were later withdrawn from marketing.

References

- Hay, M. and Thomas, Craighead, L., et al. Clinical development success rates for investigational drugs. Nature Biotechnol., 2014; 32, 40-51.

- Carton, J.M. and Strohl, W.R. Protein therapeutics (Introduction to biopharmaceuticals), In: Biological and Small Molecule Drug Research and Development (R. Ganelin, R. Jefferts and S. Roberts, eds), Academic Press, Waltham, MA, 2013, pp. 127-159.

- Kaspar, A.A. and Reichert, J.M. Future directions for peptide therapeutics development. Drug Discovery Today 2013; 18, 807-817.

- Hossain, M.A.; Belgi, A.; Lin, F., et al. Use of a temporary “solubilizing” peptide tag for the Fmoc solid-phase synthesis of human insulin glargine via regioselective disulfide bond formation. Bioconjugate Chem. 2009; 20, 1390-1396.

- Kung, Y.T.; Du, Y.C.; Huang, C.C., et al. Total synthesis of crystalline bovine insulin. Sci. Sin. 1965; 14, 1710-1716.

- Samuel, C.J.; Lin, F.; Zhao, C., et al. Improved chemical synthesis and demonstration of relaxin receptor binding activity and biological activity of mouse relaxin. Biochemistry 2007; 46, 5374-5381.

- Kent, S.; Sohma, Y.; Liu, S., et al. Through the looking glass—a new world of proteins enabled by chemical synthesis. J. Pept. Sci. 2012; 18, 428-436.

- Thundimadathil, J. Controlling endotoxin contamination during peptide manufacturing. Controlled Environments, www.cemag.us, Nov. 1, 2012 issue.

- Thomas, D. A big year for novel drug approvals. BIOtechNOW, Jan. 17, 2013.

- DiMasi, J.A.; Feldman, L.; Seckler, A., et al. Trends in risks associated with new drug development: success rates for investigational drugs. Clin. Pharmacol. Ther. 2010; 87, 272-277.

- DiMasi, J.A.; Reichert, J.M.; Feldman, L., et al. Clinical approval success rates for investigational cancer drugs. Clin. Pharmacol. Ther. 2013; 94, 329-335.

- Samaha, L. How to estimate a drug's chance of success in a clinical trial. Earnings View, www.earningsview.blogspot.com, July 12, 2012.

- Mackin, W.M. Neuprex Xoma Corp. iDrugs 1998; 1, 715-723.

- Highleyman, L. FDA committee unanimously votes to approve tesamorelin (Egrifta) for lipodystrophy. www.HIVandHepatitis.com, June 4, 2010.

- Reichert, J. Summary: Trends in the clinical development and approval of peptides. In: Development Trends for Peptide Therapeutics. Peptide Therapeutics Foundation, 2010.

- Otvos, L. Peptide-based drug discovery & development, common misconceptions. Pharm. Outsourcing Mar/Apr 2014; 15(2), 40-43.

Professor Laszlo Otvos’ current research focuses on the development of antimicrobial peptides to resistant infections as well as agonists and antagonists to adipokine receptors. His first-of-kind and optimized peptide analogs show promising preclinical advantages over conventional therapy against not only bacterial infections, but also metabolic and cardiovascular diseases, certain cancer types and arthritis forms. Currently Laszlo serves as Councilor for the American Peptide Society, Regional Editor for Protein and Peptide Letters and Senior Editor for Biochemical Compounds. His research papers have been cited more than 12,000 times.