Abstract

A screening compound collection is recognized as a valuable asset by most pharmaceutical companies and Compound Management is now a key component of the Drug Discovery process. Under-valued and under-resourced until relatively recently, compound management has now benefited from large capital investments to build “state-of-the-art” compound repository stores. However, in this era of mergers and acquisitions, large pharmaceutical companies are facing major challenges with respect to inventories of research compounds. Often, mergers result in compounds being located at various sites and using different technologies, without the benefit of a consolidated database of the global inventory. The expense and logistics of maintaining more than one repository store may force pharmaceutical companies to make the strategic choice to outsource their inventory to an external service contractor.

Compound Inventory - Cost of Ownership

Screening compound collections are very often compared to the “crown jewels” and in the past 5-10 years medium and large pharmaceutical companies have spent many millions of dollars investing in both compounds and the infrastructure to manage them. The infrastructure very often includes construction of a brand-new facility and investment in both hardware and software with the installation of new automated liquid compound storage linked to a powerful inventory database.

Compound storage, and particularly automated liquid storage, the current standard for most High Throughput Screening (HTS) operations is expensive. On top of the massive capital investments in storage, laboratory space and equipment, the company very often needs to reformat their current collection according to the specification required by the selected system. Quite often, the implementation of a new system causes significant down time and impacts other drug discovery activities.

Storage in the dry form (solid) affords a longer “shelf life” compared to storage in solution. However, the use of solvent is generally a necessity for the automated dispensing of large numbers or small amounts of sample required for HTS. DMSO (Dimethyl Sulfoxide) is the most common solvent used due to its good solvating ability for compounds, relative chemical inertness, and relatively high freezing points. Samples are typically stored either at room temperature or in a frozen state (4oC or -20oC). Recent studies regarding liquid storage conditions and the stability of DMSO solutions have been reported in the literature and have helped to develop a better knowledge and understanding of the important factors causing compound decomposition. This permits a significantly better quality of liquid samples to be achieved [1]. In parallel, the development of efficient automated sample storage and retrieval systems has contributed to a reduction in the number of compound management operations linked to a solid sample. Therefore, the equipment required to manage the solid collection is less sophisticated and very often not fully automated even for the biggest companies.

With an average of 1.8 million compounds per collection, these compound repository stores are focused on achieving and maintaining sample integrity. In addition to the storage format, time, temperature and the structural characteristics of the compound many other factors may affect compound stability. In particular, these include humidity and repeated freezing and thawing.

Sample integrity is generally regarded as a measure of the quality of the material in the container and relates to: (1) The chemical identity (structure) of the compound - Is it what it is on the label? (2) The purity of the sample - Did any impurity appear as a consequence of compound decomposition during storage? and (3) The concentration of liquid sample.

A successful compound management system requires at least the following properties:

- Ensure compound accessibility: customers can access the compounds they need when they require them and in the format they need. The sample delivery is accurate, precise and reproducible.

- Maintain compound integrity: the quality of the repository compounds is very important to the drug discovery effort. Poor sample quality can cause many problems in biological assays

- Enable efficient compound usage: limit compound wastage during the compound management process.

- Flexibility to adapt to new demand: be able to adapt to new strategies and technologies used for Drug Discovery.

- Ability to maintain a dynamic collection: be able not only to add new samples but also to remove undesired compounds from the collection.

- Availability and Integrity of inventory data: the lack of, or inaccuracy of, inventory data is a major source of inefficiency and frustration.

Today Compound Management is recognized as a vital and integrated part of the Drug Discovery process. However, despite these recent efforts and major capital investments, most of the large pharmaceutical companies are still facing significant challenges with respect to disconnected inventories of research compounds located at various sites, particularly after a succession of mergers and acquisitions. The cost of maintaining several compound repository stores compared with having one unique compound repository is high. With the recent dramatic increase in the size of screening collections, very often none of these facilities are large enough to accommodate the entire collection and the new company will have to go through a new expansion phase, with a consequent increase in costs. There also remains the question of how best to make these collections available to the entire company. A compound only has value if it is usable! Compound collections will almost certainly need to be moved; management will have to decide where and consequently may have to make difficult decisions leading to internal conflict. One of the possibilities to solve these issues may be to take a neutral outsourcing path [2].

Outsourcing Compound Management: Change from Traditional Thinking

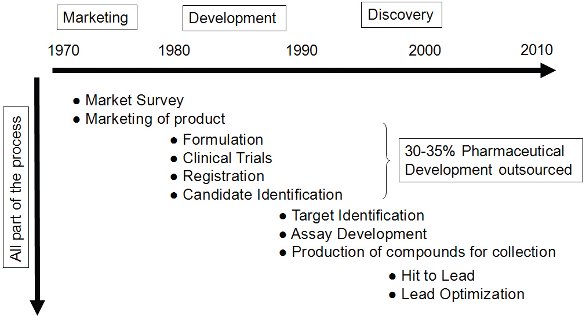

Historically, the pharmaceutical industry is no stranger to outsourcing (Figure 1). Outsourcing in pharmaceutical development is, to date, estimated at 30-35% and is continuing to grow. However, pharmaceutical companies have more recently considered outsourcing at earlier stages in Drug Discovery [3].

Figure 1 - Outsourcing in Pharma Industries

The main benefits of outsourcing are both economic and organizational. Strategic outsourcing can be a cost-effective alternative to in-house operations by providing access to the latest technology and/or sufficient operational capacity, avoiding costly capital investment, technical obsolescence and by decreasing depreciation. Most compound management groups are familiar with the use of service contractors, however, until recently the business driver for outsourcing in compound management was mainly used only when internal capacity and flexibility was an issue. For example, service contractors are very often involved during the implementation of new repositories or the movement of large numbers of samples. This ensures that day-to-day activities are maintained in an undisrupted manner. The tasks of physically moving, organizing and preparing new samples may then be most economically handled through outsourcing. Some customers may even prefer the extra fees to have these tasks performed in house in order to avoid transfer of compounds and potential intellectual property and legal issues.

Service contractors specialized in compound management offer different types of services such as weighing, plating and reformatting, procurement, quality control and storage. Although outsourcing offers the full panel of expertise required in compound management, to date, only two of the top 10 pharmaceutical companies have made the jump and decided to outsource their full inventory to service contractors – one of them limited the contract to their solid sample library only. Big pharma may tend to be conservative when it is about “one of their best assets,” the “crown jewels.” Change may, however, be in the air! Most of them have now become more and more familiar with outsourcing, in particular, for chemistry-related functions and medicinal chemistry projects to service contractors and collaborators. Some of these companies are even located in India or China, where the economic conditions create a comfortable environment for the customer. Pharmaceutical companies will inevitably learn and realize that compound collections can be treated in a similar manner to other functions that they have already successfully outsourced without any major issues.

Outsourcing to Exploit a Key Asset

Without any doubt, outsourcing compound management requires a change from traditional thinking. It is a strategic commitment involving difficult and risky management decisions. The number one risk is the externalization of management and storage of the “crown jewels.” Not physically having the compounds in house may be perceived as loss of control. Even if it is not true, it is an important strategic decision.

In addition to the “loss of control” feeling there are two other aspects limiting the development of the outsourcing strategy: the need of these compounds for in-house screening operations and the maturity of the market place for such service suppliers. The number of contract organizations that conduct compound management services at the scale of large pharmaceutical companies with large storage and retrieval capacities is still limited and quite often the signature of contract will involve building new infrastructure as warehousing, storage systems and the development of robust data management systems.

In some circumstances, such as post-merger/acquisition re-organization when compound collections need to be moved between sites or brought together into a single collection the decision to use a “neutral” outsourcing path rather than favor one of the legacy compound repository stores may help to prevent internal management conflicts and emotional discussions. This is an attractive option but it will be extremely difficult to re-initiate an internal compound collection without significant new capital investment in the construction of a new storage area and the risk that internal expertise is lost as part of the process.

The three main requirements when considering outsourcing the entire inventory are:

- Physical Security of the Samples: Screening collections are priceless assets which in many instances are irreplaceable and their storage should not only be safe and protected from fire, extreme weather or earthquakes (in some areas) but for some customers the storage area should also be separated from other business conducted at the contractor’s site with limited access security, tracking employees’ hours and time working in the particular area.

- Robust and Reliable IT Infrastructure: In order to protect the intellectual property information both IT security and interface are critical. The contractor should be able to demonstrate the presence of good firewall/Chinese wall if separate database and server approach are not feasible for each customer. No structures should be stored in the contractor’s system. All the operations should be completely bar code driven. The data exchange between internal and external systems should be in real time via a secure interface.

- Back up or Disaster Recovery Plan: A back up copy of the screening collection stored at a different location may be an option to consider. Very often the existence of both the solid and the liquid samples of the same screening collection may be sufficient if physically separated. Each of these formats may be used as a back up in case of loss of either one of them. In some cases, one of these formats (solid sample) is outsourced to a contractor when the second one (liquid sample) is managed internally.

The process of outsourcing starts with the identification of potential partners and continues with selection, negotiation of contract, management of the work and adequate reporting. Successful outsourcing operations should result in cost reduction, increased operational efficiency and optimization of resource allocation. However, there are pitfalls to outsourcing including poor partner selection and inadequate implementation.

Figure 2 - Sourcing the Right Partner

Sourcing with the right partner is the key for success (Figure 2). It takes time to develop the level of trust required for such an operation. Due diligence includes site visits and updated quotes. Facilities and IT investigations should carefully be conducted and in-house compound management experts should be engaged very early in the process, even if this generates some animated discussions!

Service levels should be better than overall current store operations with better consistency, flexibility and a real financial benefit. Regarding this last point, companies should consider reducing cost while still maintaining the highest standards in compound management. The saving of cost, mainly due to the reduction of both maintenance and FTE, is estimated at 1/3 particularly for the solid inventory where basic warehouse and manual retrieval/weighing seem to be the standard from service contractors. On the other hand, the financial benefit of outsourcing liquid sample management, which includes operations such as solubilization, formatting, storage and retrieval, may be less obvious. The need to meet the high-quality standards currently in place in the industry, together with the requests for sophisticated equipment, automation, specific consumables, and expensive storage and retrieval facilities make this a more challenging proposition.

As the quality of the compounds within the screening collection is very important to Drug Discovery, pharma companies should expect the same level of quality regarding their samples as when performed in-house and one of the key considerations will be to avoid jeopardizing the integrity of their screening collection by selecting a partner on the basis of price alone.

Future Developments

Today it is difficult to foresee the future developments regarding outsourcing of compound management activities. The decision to outsource such operations requires time and a clear business decision. The objectives to reduce both internal fixed costs combined with strategies for increased outsourcing of drug discovery activities, may boost the growth of the market of service contractors specializing in compound management. In this eventuality, big pharma may be a good catalyst for this emerging market. However, small companies and start-ups which are keen to minimize their capital investment, may decide to outsource their compound management rather than develop this activity in house and may also contribute to this next focus for outsourcing contractors.

Acknowledgements

I would like to thank Dr. John Mathew and Kimberly Matus for their input and helpful discussions.

References

- Cheng, X., Hochlowski, J., Tang, H., Hepp, D., Beckner, C., Kantor, S. and Schmitt, R. “Studies on repository Compound Stability in DMSO under various conditions.” Journal of Biomolecular Screening 2003 8(3) 292-304

- Lease, T. and Stock, M. “Compound Management: The next focus for outsourcing?” Pharma 2008 (Sep/Oct) 22-23.

- Cavalla, D. “The extended pharmaceutical enterprise” Drug Discovery Today 2004 8(6) 267-274.

Sylviane Boucharens, Ph.D. is a Section Head at Merck, Newhouse, Scotland. She is currently responsible for the Compound Management and Automation for in-vitro screening for Lead Optimization and Lead Finding activities. Involved in two consecutive acquisitions; Organon by Schering-Plough (2007) then Merck (2009) Sylviane has worked closely alongside her USA colleagues with respect to the compound library integration and inter-site compound distribution. She has also been involved in a number of Outsourcing projects regarding Compound Management, High Throughput Screening, Chemistry and Assay development.

This article was printed in the November/December 2010 issue of Pharmaceutical Outsourcing, Volume 11, Issue 7. Copyright rests with the publisher. For more information about Pharmaceutical Outsourcing and to read similar articles, visit www.pharmoutsourcing.com and subscribe for free.