Introduction

The use of external resources (people, equipment and/or expertise) to facilitate the preparation of API (Active Pharmaceutical Ingredient) or advanced intermediates has become a common practice for most pharmaceutical development organizations. In early development (i.e. up to and including Phase 2a/Proof of Concept) the reasons to seek external support for the manufacture of API can be influenced by a number of factors, including a lack of sufficient internal capacity, a need to source unique technical expertise or a desire to achieve overall cost reductions. For organizations which have no internal GMP manufacturing capabilities whatsoever (e.g. biotech companies), outsourcing is, of course, a necessity. However, companies which have some level of internal manufacturing capacity may have options to use outsourcing to their strategic advantage. By judiciously selecting which projects to internalize and which to outsource, the use of available capacity and capabilities can by optimized across a portfolio.

Reasons for Outsourcing in Early Development

Consider, for example, the dynamic picture of API demand at the portfolio level. Looking across all active projects within a company, one would expect the need for API manufacturing to vary over time, perhaps quite significantly. As new candidate molecules are nominated for development, this triggers a need for API synthesis in support of planned toxicology, clinical and pharmaceutical development studies (primarily drug product formulation). At the same time, other active development projects may be placed on hold, de-prioritized or terminated, at which point any ongoing API activities are typically brought to completion. This rapid cycling of API demand across a portfolio is especially true in early clinical development where attrition rates are high and project terminations are often quickly supplanted with back up candidates.

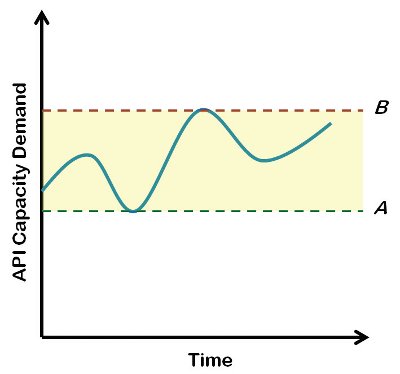

Figure 1 - Hypothetical model of variable capacity demand-This graph shows how the demand for API manufacturing capacity (blue line) can vary over time. If internal API resources are maintained at or below line A, supplemental capacity (outsourcing) will always be required, while above line B, some internal API capacity will remain idle. The region between lines A and B offers an opportunity to use external outsourcing to complement internal manufacturing capacity on a demand-driven basis.

This broader portfolio view is graphically depicted in Figure 1, whereby the collective demand for API manufacturing capacity can be expected to vary over time. If internal resources (people, equipment and the necessary expertise) are staffed at the level of line A or below, then some level of outsourcing will always be needed in order to fill the demand gaps for API synthesis. In the current financial environment of trying to minimize fixed costs, maintaining internal capacity at or below the anticipated demand minimum, assures maximal use of these internal assets. By contrast, if internal resources are maintained at a “worst case” level of peak demand (line B), then facilities and people will remain idle at all other points along the time continuum. This latter scenario is undesirable as demand peaks are difficult to predict and, until they are actually needed, there will be a high cost associated with the unused assets. The intermediate situation, whereby internal staffing and the corresponding API manufacturing capacity are maintained at a level somewhere between lines A and B, may be a desirable strategy for many pharmaceutical development companies. This does mean that, at certain points in time, resources will be underutilized. However, this is often an acceptable compromise in a research and development environment where the fluctuation in demand is anticipated. Pilot plant facilities are not intended to be operated continuously at full capacity and human resources can usually be diverted to other active projects without added cost. As with the first scenario, in times of peak demand, outsourcing of API activities becomes a logical complement to internal capacity.

Another reason for outsourcing is to access technical expertise that is not otherwise available in-house. This may be the result of a strategic decision not to invest in a particular technology simply because it isn’t cost effective to internalize when the need is relatively infrequent. A number of technologies fall into this category and are readily accessible from a number of high quality providers (e.g. chiral catalysis, enzymemediated reactions, chiral separations, high energy reactions, particle size reduction, etc.). In early development, when API synthesis is a critical path activity, the ability to quickly access and make use of external expertise to solve a specific technological problem can be particularly advantageous and will often pay for itself in time savings alone.

Finally, achieving a net cost reduction can be a third driver for choosing to perform API work on the outside. However, the direct substitution of internal manufacturing with a lower cost CRO (Contract Research Organization) does not automatically lead to a cost savings. In fact, this situation could leave internal assets underutilized while incurring additional external expense, leading to a net increase in overall costs. Rather, the real savings comes from knowing which work can be done more efficiently on the outside versus what is best performed internally. By developing a strategy that seeks to align and optimize API synthesis needs with the available expertise (using both internal and external capabilities) an overall cost reduction on a portfolio basis can be realized.

Outsourcing Partner Considerations

The availability of outsourcing providers continues to be a dynamic landscape and multiple choices abound [1]. As such, there are a number of factors to be considered when selecting a CRO or Contract Manufacturing Organization (CMO), with capability, capacity and quality being the most obvious and important [2]. Simply put, can a partner do the work that you will offer them and can they meet the quality standards (cGMPs) that you expect for your API or intermediate? A careful and thorough assessment of this question via the due diligence process is necessary to assure the technical success of any given project and the acceptability for use of the end product. Cost is another powerful driver in an outsourcing decision. Cost models will certainly vary across the CRO/CMO spectrum and are typically proportional to the technological prowess, extent of manufacturing infrastructure and the maturity of quality systems at a given supplier. It is also easy to benchmark against internal costs which can help to manage expectations for certain, well-defined deliverables (e.g. x kilos of API using a known process). When multiple price quotes are received for a requested service, a temptation may exist to go with the lowest cost option. Yet, the decision is rarely that simple and the relative importance of cost must be weighed against all other success factors.

There are less obvious or otherwise over-looked criteria that should also be considered and can help to build a successful outsourcing strategy. One of these is geographical location [3]. What is an acceptable travel radius away from your research center and what are the expectations for managing the distance between yourself and a potential partner? After the business transactions are completed (CDA, RFP, Master Services Agreement, Quality Agreement, etc.), every project will involve some level of technology transfer and ongoing scientific dialog between the two companies. At one level, this could take place by face-toface meetings where reports, data and project knowledge are carefully discussed and know-how is transferred directly between scientists. If this is preferred, it will dictate working with either regional partners (same time zone, accessibility by car or very short flights, and a likelihood of sharing a common language) or possibly continental partners (minimal time zone differences, accessibility by moderate flights, and a possibility of a common language). Alternatively, it may be sufficient to transfer project documents electronically and work through the details by teleconference or e-mail with very little direct scientist contact. Under these circumstances, the option of conducting business predominately by electronic means offers much greater flexibility to manage projects in a global environment and allows global partners to be considered (large time differences, accessibility only by long flights, and having a common language unlikely).

Yet, because this is early development, it is inevitable that something will go awry technically with one project or another. When this does occur and there is an expectation for the sponsor to step in and help with real-time support or trouble-shooting, then the above considerations of proximity become very important. If a CRO is technically competent and expected to solve these problems independently, then geography is less of a deciding factor and global sourcing options again open up. To the extent that technical complications might actually be anticipated in advance (often related to project complexity) can factor into the sourcing strategy and is further discussed below.

Sourcing Decision Tree

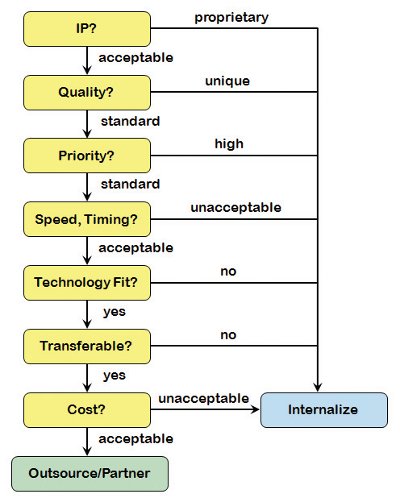

Figure 2 - Decision tree for project outsourcing-In a stepwise approach, critical aspects of a specific project are analyzed to determine the acceptability and suitability of outsourcing versus keeping the activity in-house.

Once a decision has been made to place some level of work on the outside, assuming there is an option to balance with internal manufacturing resources (vide supra), then choices have to be made about which project(s) to outsource. Presented in Figure 2 is a decision tree approach that critically analyzes a project against several key variables and helps to align a project with the available capacity and technical expertise, without compromising the over-arching compound development program. This decision tree is modular in the sense that blocks can be added, removed, edited or even reordered to match internal business priorities (although a reordering should lead to the same decision result in the end).

Each of the individual decision points is discussed in further detail:

Intellectual Property. Intellectual property (IP) is typically of highest importance to a pharmaceutical innovator. Even though every outsourcing agreement should be covered by a CDA (Confidentiality Agreement), the control of IP is still an area of concern to many companies. To the extent that sharing project-related information externally carries an unacceptable risk of potentially losing some competitive advantage, it becomes an easy decision to keep the project (and the accompanying proprietary information) in-house. Even when IP coverage is fully expected via the patent process, it still may not be desirable to reveal information in advance of the abstract publishing (e.g. unveiling a new structural class that relates to a particular biological target). In the absence of IP concerns, a project can be considered further as a possible outsourcing candidate.

Quality. Aside from the standard cGMP expectations for manufacturing API and advanced intermediates, there may be unique product quality considerations that dictate where a compound can (or cannot) be made. For example, if an extremely stringent purity requirement (e.g. ultra-high product purity or tight control of trace level impurities) is coupled to a very specific, limited availability purification technology (e.g. preparative HPLC, chiral, Simulated Moving Bed, or preparative supercritical fluid chromatographies), this now becomes a requirement for the project. If in-house facilities are available, it may be preferable to retain control of the purification and quality control steps internally. Alternatively, if this capability does not exist within an organization, it now becomes the deciding factor for taking the work external.

Priority. In virtually all instances, an outsourced project will take longer to complete than would otherwise be required to execute internally. Negotiations, agreement preparation, and information/knowledge transfer all factor into timeline extension. For a project which carries an “average” or “standard” priority classification (dependent upon company rating systems), such minor delays are likely acceptable and manageable. The exception would be for the highest projects within a company’s portfolio. In these instances, to the extent that API delivery impinges on the critical path (as is often the case in early development), the additional time requirements will likely not be acceptable and the preferential choice will be to keep the project internal.

Speed, Timing. This decision point simply evaluates the acceptability of the proposed delivery date of an outsourced API, irrespective of project priority. As mentioned earlier, it is possible that API is on critical path and an external timeline for API manufacture is not acceptable to the compound development team. If this is the case, then alternate (likely internal) options will need to be pursued.

Technology Fit. If the synthesis route has unique technology requirements, these will need to be carefully considered and matched against the available capabilities. This decision point can be a broad category which encompasses many different variables. To begin with, there may be worker safety aspects associated with the API or its intermediates that have to be managed, such as high potency or known genotoxicity, which require some level of containment facilities. If there are process safety hazard concerns associated with the chemistry, sufficient expertise must be in place to first assess the level of concern (via DSC, ARC, reaction calorimetry, vent sizing package, etc.) and then, when applicable, monitor and control the critical reaction parameters during scale up.

Scale itself might be a consideration (for either final API or intermediates), especially where high dilution reactions or large volume work-ups call for larger reactor sizes. While this limitation can often be overcome by running multiple smaller batches, the additional processing that is required will add to the delivery time and increase the labor cost. Equipment and processing requirements might be another deciding factor, including chemistry which calls for unique materials of construction, specific temperature constraints (cryogenic or very high temperatures), or high pressure conditions (including hydrogenation).

Lastly, product purification and isolation aspects should be evaluated. The need for technologies such as large scale chromatography or high-vacuum distillation will limit options for outsourcing. Likewise, polymorph and particle size control (via wet-milling, milling or micronization) calls for some level of expertise and suitable processing and monitoring equipment.

As with the Quality attribute described above, to the extent that these requirements can be met internally versus needing a partner to access the technology drives the sourcing decision in one direction or another.

Transferable. Transferability is a qualitative measure that tries to capture how well a third party might execute the chemistry at hand, given the quality of the technology transfer package and coupled with the amount of internal consulting and oversight that is expected to be available. Experience teaches us that sensitive or under-developed APIchemistry does not transfer well and numerous interactions between scientists can be expected in order for the project to reach a successful conclusion. In these instances, it may be easier to let the CRO start from scratch on a project rather than try and transfer a limited knowledge basis and endure the time and cost required for the CRO to climb the learning curve.

If the project is expected to be problematic in some measure, there should be a preference to internalize. On the other hand, well-understood chemistry, and particularly those routes that have been demonstrated at some moderate scale, can be ideal candidates for outsourcing and ultimately offer the best chance of success (“Right first time”).

Cost. The final consideration is cost. However, this is not an evaluation of the expected cost savings that are associated with using a CRO or CMO. In adopting the capacity demand model originally presented, it is a foregone conclusion that some level of work will be place externally and, at the portfolio level, some degree of cost savings will be realized. Rather, this cost decision point should be nothing more than a quick evaluation to assure the price quote is not some multiple of what might be expected internally and there is an acceptable value proposition for conducting the work externally.

Summary

In summary, an early development API strategy is presented which uses outsourcing as complement to internal manufacturing capacity and capability in conjunction with the ebbs and flows of API demand across a project portfolio. Some considerations for partner selection are discussed which help to set the stage for a successful execution of this strategy. Finally, a decision tree approach towards determining which projects should be outsourced versus kept internal is described. While the decision points that are important for most pharmaceutical companies are explained in detail, this approach can be further customized to adapt to the particular concerns of a given company.

References

- Mullin R, Stateside Surge in Pharma Chemicals, C&E News, September 28, 2009, page 38.

- See also: Toupence R, Early Stage API and Intermediate Outsourcing – Building Effective Partnerships, Pharmaceutical Outsourcing, May/June 2010, page 34.

- Tremblay J-F, Mullin R, Everts S, Shopping the World, C&E News, November 26, 2007, page 13.

Mark A. Krook joined Johnson & Johnson in 2007, after 22 years with Pfizer and the legacy Pharmacia companies where he held positions of increasing responsibility in the chemical process R&D arena. He is currently Senior Director of Portfolio Management – Small Molecules, where he has oversight responsibilities for CMC activities supporting all phases of clinical development. Prior to 2010, he was leading the US API Development group within J&J and also had matrix responsibility for all CMC activities supporting US early development. With his previous company he led global chemical process R&D groups whose responsibilities included early phase clinical support, pilot plant manufacture, late phase process development and post-approval commercial support. A commonality across all of these organizations was the varying degree to which outsourcing was used to complement the full spectrum of internal API development activities. Mark received his B.A. in chemistry from the University of St. Thomas in 1981 and a Ph.D. in organic chemistry from the University of Notre Dame in 1985.

This article was printed in the November/December 2010 issue of Pharmaceutical Outsourcing, Volume 11, Issue 7. Copyright rests with the publisher. For more information about Pharmaceutical Outsourcing and to read similar articles, visit www.pharmoutsourcing.com and subscribe for free.