Like many industries, the Pharmaceutical sector is facing a number of major challenges over the next few years. The economic pressures are significant due to patent expirations, generic challenges, more stringent regulatory processes and pricing pressures as health care costs escalate. For example, the pharmaceutical sector in the next few years will face 40% of branded products going off patent, which equates to about $100 billion worth of sales for the industry. [1]. In parallel, R&D costs have been escalating and the number of FDA-approved drugs each year has diminished [2]. Companies can no longer bank on the “block buster approach” to remain viable.

In order to survive in this climate, companies must transform themselves by taking new approaches that include exploring a diverse set of products and offerings. Not only exploitation of traditional chemical entities, but also diversification into biologicals and enhancement of profitable avenues such as OTC and consumer health care. Exploration of emerging markets and alliances with partners in academia and smaller Biotechs will enable companies to leverage novel technology and identify new disease targets. This in turn will lead to better medicines and a solid foundation for sustained growth.

To maintain immediate viability, companies are looking at simplification and cost containment measures. Such measures include outsourcing functions which are more cost effective externally and which are not core business. Streamlining and removal of unnecessary bureaucracy along with rebalancing budgets so that instead of increasing budgets, money is realigned to areas with the, “biggest bang for the buck.” In GSK, this means shifting resources to pipeline execution where large numbers of potential new medicines are can be fast tracked with the application of more resource and investment.

So what does this mean to Compound Management (CM) groups? CM faces a number of challenges in light of the transformations happening in their R&D organizations.

These include:

- A more diverse customer base

- Geographically

- Organizational

- Cost containment

- Management of diverse materials

- Increasing sample logistics

At the same time, CM organizations have been evaluating their own value streams. What are their core strengths and attributes and how can they add value to the changing R&D organizations and customer base? Key Quality Indicators (KQI’s) are service features or quality attributes which benchmark the performance of an organization. Within CM these have traditionally focused on monitoring underlying infrastructure performance, for example, how fast can our robots go? More recently, we have been trying to develop true KQI’s based on factors which customers expect and value and which are more relevant to this changing customer base.

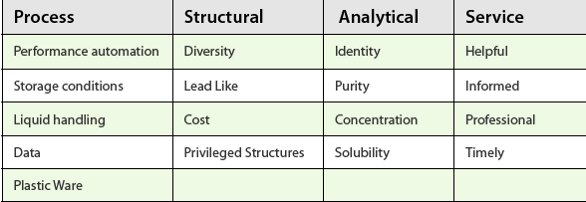

Table 1- Compound Management Key Quality Indicators

The three KQI’s that benchmark CM organizations are cost, cycle time and quality. Five years ago in the development of the HTS processes, cycle time was the most prominent of these. More recently, quality has come to the forefront. Quality in a CM operation covers four main areas: process, structural, analytical and service quality (Table 1).

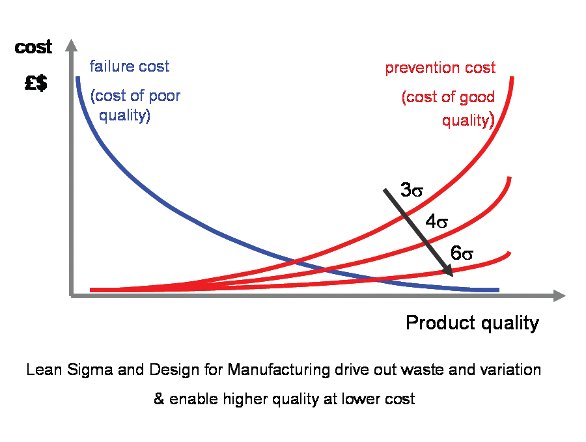

The cost of quality is a comprehensive concept covering the cost of both poor and high quality. Costs do not result from only producing and fixing failures; a large amount of costs comes from ensuring that good products are produced.

Delivering a high-quality operation can be expensive, so it is important to define the level of service quality at which the total cost of quality is minimized. Finding it and then operating at this level should be the goal. Because there are no absolute standards for quality, it becomes, in the final analysis, whatever you (or your customers) say it is.

Figure 1- The Cost of Quality

The core strengths that CM organizations offer are the ability to manage large collections of materials which have been supplied by a geographically diverse set of producers and provide these materials to a diverse set of customers with differing formats and requirements. At the same time maintaining timeliness, quality and compliance with government and corporate regulations and providing an audit trail of the transactions history and the accompanying chemical and analytical data.

CM professionals have a diverse skill set to match the diverse functions they perform, including expertise in automation, technology development, liquid handling, analytical sciences, logistics, IT, customer relations and process improvement.

With the diversification of R&D there is recognition that the core skills and systems developed by CM can be exploited to maintain and provide services associated with collections other than traditional chemical libraries, these include DNA, antibodies, proteins, and RNAi (ref). For example, within GSK CM have recently taken on the management of RNAi samples and encoded libraries.

Alliances and partnerships with Academia and Biotech organizations have provided some interesting challenges for CM. The requirement is to provide these organizations with access to large Pharma capabilities without overburdening them with systems and infrastructure. Specifically for CM, this means sharing best practice and support whilst providing more flexibility in services than previously needed. An example here would be for the provision of material in formats and amounts that have not been previously encountered. The other main challenge is maintenance of intellectual property for both the main organization and its partners. This has required the development of new IT tools to track and maintain histories of material transfers and restrictions for testing and distribution. Such tools automate the process of restriction in ordering, testing and transfer as required.

The globalization of R&D has necessitated developments to CM logistics to ship and import material from more countries. Most CM organizations utilize 3rd party logistic providers to ship materials to different countries and this is a relatively seamless process when they have systems and infrastructure in place. This is not the case for countries like China and India, and significant difficulties in shipping and handling have been encountered. For example, for the 3-6 months prior to the 2008 Olympic games, import of material to China was significantly restricted. It is imperative as more R&D and chemical synthesis is carried out in different countries that a streamlined and efficient shipping infrastructure is established.

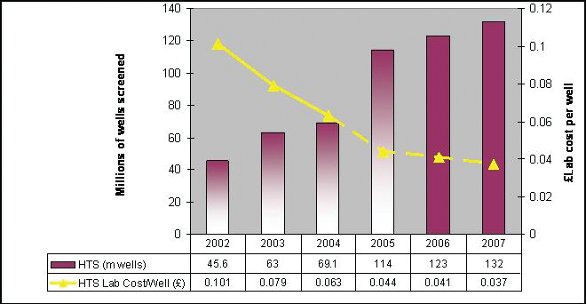

Figure 2-Productivity in High Throughput Screening

Working with partners in screening and assay development, organizations have managed to reduce cost per well significantly. This cost reduction has been achieved by miniaturization enabled by low-volume dispensing and assay technology. Figure 2 illustrates the cost per well reduction that has been obtained over the last six years with costs reduced from 10 pence per well to 3.7 pence per well.

This cost reduction has not been achieved without significant investment in automation and technology. CM has had a significant capital investment in large automation and IT solutions to enable them to manage the increase in corporate collections and demands from HTS and lead optimization. Five years ago there was less scrutiny on cost benefit and ROI; however in today’s economic climate the criteria for investment will be more stringent. CM organizations need to develop more expertise in investment decision making. In addition, the emphasis has shifted from new investments in automation platforms to extending the lifetime of existing systems. Skills in automation and engineering needs to come to the forefront in order to plan for obsolescence part replacement, to develop strategic spares holdings and to establish appropriate preventative maintenance schedules. Partnership with vendor experts is important to ensure that a systems full capabilities and lifespan is achieved and maximizing ROI by adding in new capabilities rather than building new systems. A good example of this has been the replacement of older liquid handlers within our Automated Liquid Stores with Acoustic Droplet Ejection (ADE) instruments.

Figure 3-Relationship between capacity utilization and cycle time through a process

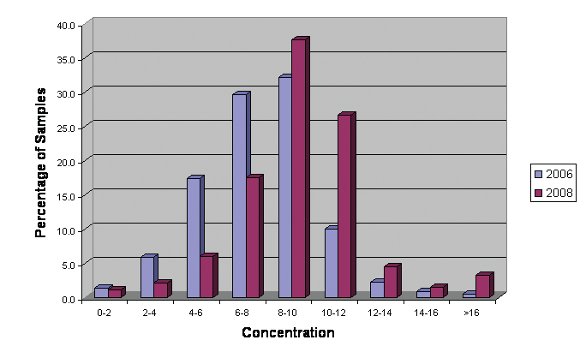

Figure 4- Concentration of Lead Optimization Samples Pre and Post Introduction of Acoustic Mixing

In conjunction with extending the life time of automation, it has become necessary to understand the capacities of these systems. Figure 3 indicates the relationship between cycle time and capacity used. Extended cycle times are caused by fluctuations in workload (or resource availability); as capacity utilization is increased the backlog due to peaks takes longer to clear. In CM processes where cycle time is important but not critical, plan on working below 75% capacity on average.CM has had a good track record of introducing and exploiting technology within drug discovery. Here again judicious cost containment and maximizing ROI is necessary.

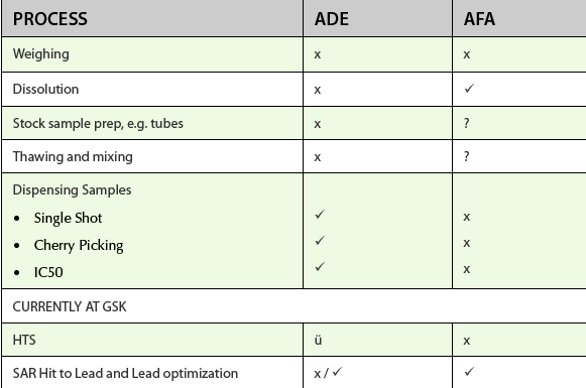

Table 2-The Use of Acoustic technology in CM process at GSK

Table 2 indicates the use of acoustic technology ADE and Adaptive focused acoustics (AFA) in CM processes within GSK. In these cases we have critically evaluated new equipment using a set number of criteria and only introduced the technology if it added value. AFA has proven to have a significant impact in the solubilization and processing of dry powders to make DMSO stock solutions. In two years we have seen a significant shift closer to the 10mM nominal target concentration.However, in other applications such as the compound solubilization from dry films or for mixing of solutions in tubes we have not demonstrated real value and subsequently the technology has not been adopted.

In the past 5-10 years CM organizations have transformed their operation to deliver a high-quality, cost-effective and timely service. Recent changes in the Pharma Industry are presenting new challenges which provide new and exciting opportunities to enhance and streamline operations. With the skill sets and knowledge within CM, other parts of R&D organizations are looking to exploit them, asking CM to diversify its operation and portfolio into new areas. The specific challenge for CM will be to maintain its core attributes and talent, publicize those capabilities to an expanding and diverse customer base while maintaining the high-quality operation it has established.

References

- Generic Competition 2007 to 2011: The impact of patent expiries on sales of major drugs.URCH publishing (2007).

- The Continuing Evolution of the Pharmaceutical Industry: Career Challenges and Opportunities. Regent Atlantic Capital LLC (2007).

- Wood, T. and Moore, K. (2007) The challenges of Compound Management. ELRIG

Dr. Sue Holland-Crimmin is Site Head and Director of Sample Management Technologies at GSK Philadelphia. She is WW leader for Quality Initiatives and coleader of Automation & Technology within GSK SMTech. She has worked in areas of Sample Management, HT Screening and IT during here career which has spanned 3 countries and major sites within the GSK operation. She holds a PhD in Biochemistry & Genetics and a BSc in Microbiology and is a trained Lean Sigma facilitator.