Introduction

Over the last 20 years, the Prescription Drug User Fee Act (PDUFA) has authorized the USFDA to collect user fees from industry to facilitate the review process for certain human drug applications. Since its enactment in 1992, PDUFA has been reauthorized six times (every five years). The fifth authorization of PDUFA, also known as Food and Drug Safety and Innovations Act (FDASIA) of 2012 focuses mainly on advancing public safety and upgrading the benefit/risk assessment of new medicines. In the year 2016, FDASIA played an important role in expediting drug approval process.

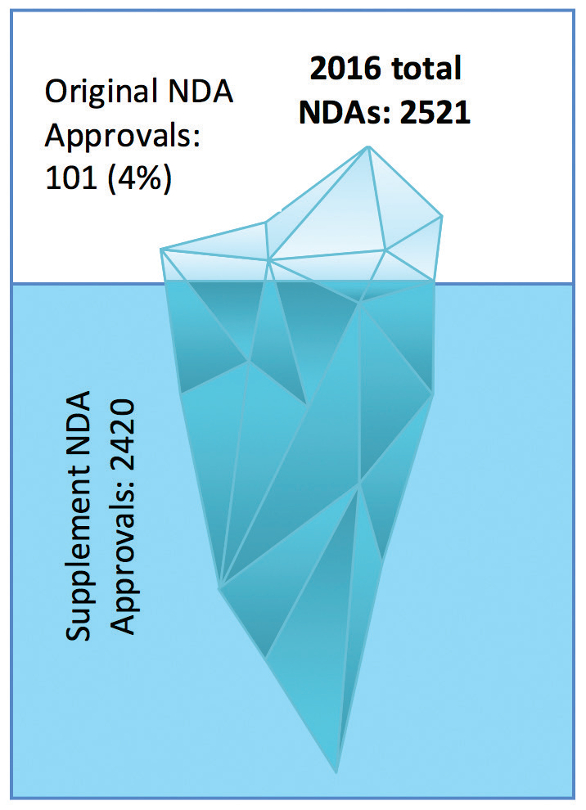

We usually cover all original NDA approvals and some of the supplements in Horizon Lines. Original NDAs are for those molecules which have been introduced in the market for the first time. The scenario in 2016 is like an “iceberg” with only 4% original NDA approvals compared to 96% for the supplemental NDAs as depicted in Figure 1. Most of the supplemental NDA approvals are for labeling (1202) and manufacturing changes (1015).

Figure 1. Distribution of Original and Supplemental NDAs

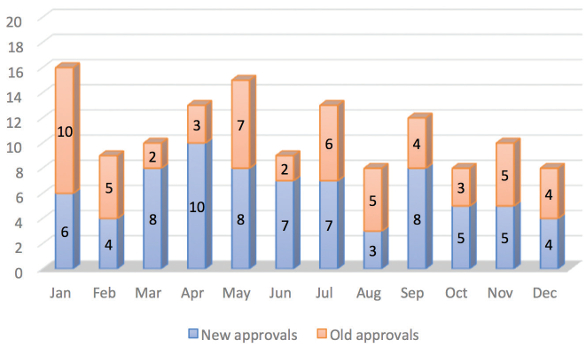

Figure 1. Distribution of Original and Supplemental NDAsThis review discusses the highlights of the drugs, which received approvals in 2016. Figure 2 provides a comparison between drugs approved as an original application and approved as a supplemental application for each month in 2016. A total of 131 NDAs were approved for new drug molecules and supplemental NDAs, which is approximately 14.9% less than that of year 2015. An average of 11 NDAs were approved per month out of which approximately six molecules were new.

Figure 2. A month-wise comparison of approvals for old and new drug molecules in 2016

Figure 2. A month-wise comparison of approvals for old and new drug molecules in 2016NDA types

The Manual of Policies and Procedures (MAPP) 5018.2 of CDER, describes the different classification codes of an NDA according to the characteristics of the product and their relationships to other approved or marketed products in the United States. There are total of 14 types of codes including four combinations (type1/4, type 2/3, type 2/4 and type 3/4). Figure 3 represents a comparison of proportions of these NDA codes for all NDAs that received approvals in 2016.

Figure 3. Different types of NDA submissions for all approved original NDAs in 2016

Figure 3. Different types of NDA submissions for all approved original NDAs in 2016Following are the descriptions of NDA codes depicted in Figure 3. Type 1: New molecular entity, Type 2: New active ingredient, Type 3: New dosage form, Type 4: New combination, Type 5: New Formulation or other differences, Type 7: previously marketed but without an approved NDA. The highest three approved NDAs in 2016 are Type 5, Type 3 and Type 1 approvals with 34%, 27% and 13%, respectively. Rosuvastatin Zinc and Prasterone were the only NDAs that received approvals under Type 2 NDA as a New active ingredient and Type 2 and 4 NDA as a New Active ingredient and combination, respectively.

A dosage form is one of the important parameters for every product. In 2016, injections were the majority (49.6%) over all other dosage forms followed by tablets (28.2%) (Figure 4). Injections include, lyophilized powder for injection, a solution, powder for solution, etc. Tablets contribute to most of the solid dosage forms. Liquids includes oral solutions, suspensions, ophthalmic solution, otic solution etc.

Figure 4. Distribution of dosage forms for NDAs approved in 2016

Figure 4. Distribution of dosage forms for NDAs approved in 2016Other dosage forms such as capsules, liquids, powders, gels, and sprays were approved in fewer numbers. Very limited approvals were reported for implants, intrauterine devices, inhalers, vaginal inserts, and ointments. An overall look at the trend for 2016 showed that injections and tablets were still the dosage forms of choice.

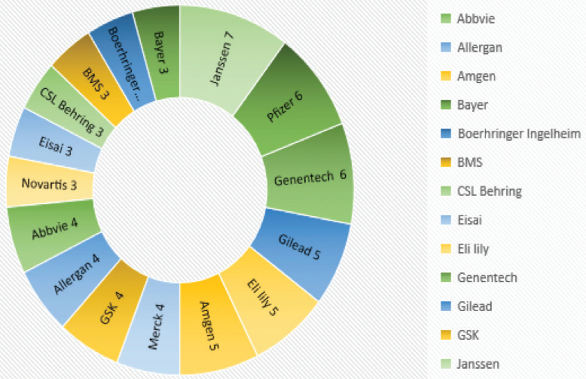

Company-Wise NDAs

Figure 5 depicts list of companies receiving three or more NDA approved in 2016. Janssen topped the list with seven NDA approvals in 2016. Pfizer and Genentech each received six NDA approvals. Novartis was at the top in 2015 with seven NDA approvals but received only three NDA approvals this year. Compared to 2015, a new company entering the top in line chart is CSL Behring who received total three NDA’s, two of which were for Hemophilia.

Figure 5. Top pharmaceutical companies receiving NDA approvals

Figure 5. Top pharmaceutical companies receiving NDA approvalsTop-in-class categories

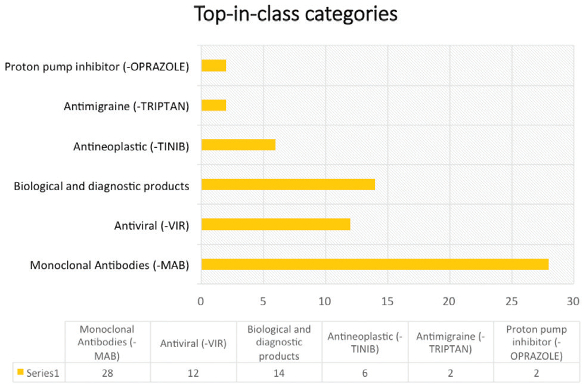

Significant amount of work is being done on monoclonal antibodies. In 2016, 28 NDA’s were approved for monoclonal antibodies, which is almost 21.4% of the total approvals (Figure 6). Major work was also observed on biological products which include vaccines, hormones and diagnostic products. Biological products became a major part of NDA approvals in 2016. Treatments for various forms of cancer were addressed the most in 2016.

Figure 6. Key drug categories receiving approvals

Figure 6. Key drug categories receiving approvalsNovel Drug Therapies

From all NDAs and BLAs that are approved every year, some products get approvals which advance the clinical care to another level. These innovative products are known as Novel drugs. For example, a molecule with a “Breakthrough Therapy Designation”, an expedited drug development tool introduced by FDASIA, is a molecule which shows substantial improvement in patients with serious, life threatening diseases during their preliminary clinical studies. In 2016, FDA’s CDER approved 22 novel drugs, approved as either New Molecular Entities under NDA or as new biologics under BLAs. Table 1 lists some of the notable novel drugs approved in 2016.

Table 1. Some noteworthy Novel molecules approved in 2016

Small and large molecules:

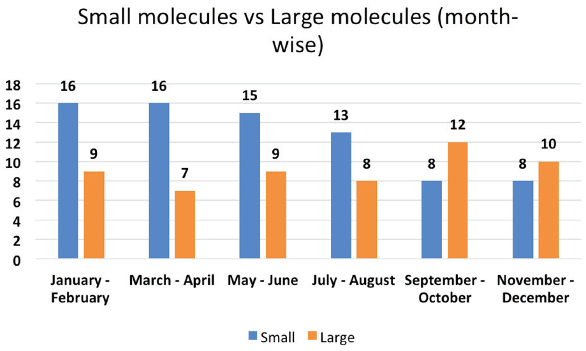

In the beginning of 2016, majority of approvals were given for small molecules over large molecules. This trend was reversed in last few months of 2016. Total 58% of total approvals were for small molecules while 42 % were for the large molecules. (Figure 7). Compared to year 2015, there has been a 12% increase in the large molecule approvals which is a notable change in one-year duration. Considering the increased need of anti-cancer, anti-diabetic and anti-viral medicines, we can expect to see a further increase in work done on large molecules in coming years.

Figure 7. Month-wise distribution of small and large molecules.

Figure 7. Month-wise distribution of small and large molecules.Conclusion

This review summarizes various trends observed for NDA approvals in 2016. It proves to be important to conduct such an analysis each year to understand year-to-year trends. Only 4% approvals were for new molecules and remaining were for supplemental NDAs. The review lists various types of NDAs out of which the NDAs approved as a new formulation or other differences were observed to be most common. A total of 22 novel molecules were approved for marketing for some serious life-threatening diseases such as Duchenne muscular dystrophy and ovarian cancer. Injection was the most widely used dosage form. Several products using monoclonal antibodies were also approved in 2016.