Introduction

The market for biopharmaceuticals continues to expand in both volume and revenue. In 2010, the US market for biologics is estimated to be $67 billion while the worldwide market is double that at $130 billion. While year-over-year market growth has slowed from its earlier double-digit rate growth rate, the number of new biopharmaceuticals coming onto the market continues to grow, and is expected to accelerate as biopharmaceutical projects currently in clinical trials obtain commercial approval. Further driving the needs for contract fill-and-finish services are pharmaceutical and biotechnology companies who will increasingly rely on outside contractors for their fill-and-finish needs.

Information Source

In the latest report by HighTech Business Decisions, Biopharmaceutical Contract Fill-and-Finish: Best Practices Study, 29 biopharmaceutical manufacturing directors at pharmaceutical and biotechnology companies and 12 executives at fill-and-finish contact manufacturing organizations discussed their current fill-and-finish services, outsource needs, prices and strategies for their biopharmaceutical products. The information presented in this article comes from this report.

Background on Biopharmaceuticals

Biopharmaceuticals are large, complex, fragile molecules compared to most small molecules, and they require specialized handling during fill-and-finish. In addition to needing an aseptic environment, biopharmaceuticals are sticky and pressure sensitive. CMOs have invested in new processes and procedures in order to preserve the biological activity of the final drug product. Increasingly, new products in the pipeline will require further special handling. For example, antibodies conjugated to cytotoxic small molecules, and live bacterial vaccines need sophisticated containment and specialized processes. New products such as these will require CMOs to continue to invest in new capabilities.

Contract Fill-and-Finish Market

Generally, companies outsource biopharmaceutical fill-and-finish to a CMO in order to access production capacity, or to access specialized manufacturing capabilities. On average, biotechnology and pharmaceutical companies with internal fill-and-finish capabilities outsource 40% of their requirements, while smaller biotechnology companies with no biopharmaceutical fill-and-finish capabilities outsource 100% of their requirements. The most prevalent reasons for biopharmaceutical companies with internal fill-and-finish capacity to use CMOs for some of their fill-and-finish needs are a) the need for temporary capacity during start-up of in-house capacity, b) the need to balance production volumes with line capacities or, c) the need for validated manufacturing for commercial products.

Pharmaceutical and biotechnology companies will also outsource their fill-and-finish needs in order to gain access to a CMO’s specialized technology. Some examples of specialized technology required by biotechnology companies may include the need for barrier isolation for handling cytotoxic material or lyophilizers for freeze-drying and stabilizing their drug product. As noted by one of the biomanufacturing directors, “Anytime we need to add production and reduce capital spending, we consider outsourcing. Fill-and-finish production is not our core competency. When we need special services like handling cytotoxics or blow fill seals, we look to contractors.”

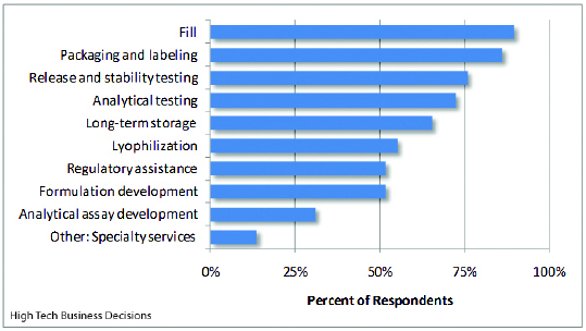

Figure 1 - Services Outsourced

CMO Services Outsourced

For our study, the biomanufacturing directors provided details on 476 projects and services that they currently contract to fill-and-finish CMOs. From these inputs, there are nine general service categories that the pharmaceutical and biotechnology companies outsource to their fill-and-finish CMO. As can be expected, most biopharmaceutical companies use their CMO for filling. Other services extensively used by the biopharmaceutical companies are packaging and labeling, and release and stability testing. The least outsourced services are specialty services and analytical assay development. A list of outsource services by percent of respondents who outsource either some or their entire project requirements by service category is shown in Figure 1.

To further analyze the fill-and-finish needs of the biopharmaceutical companies, we segment the services outsourced between those companies with internal fill-and-finish capacity and those companies without internal fill-and-finish capacity. From our study approximately one third of the biopharmaceutical companies have internal fill-and-finish capabilities while two thirds of the biopharmaceutical companies have no fill-and-finish capabilities. In testing the significance of these two market segments using the Mann-Whitney test for independence, there is a difference in the services outsourced to CMOs by segment at the p-value of 0.05. The test for independence shows a significant difference between the outsource practices of the two market segments. A review of the service categories by segment shows that the biopharmaceutical companies with no fill-and-finish capabilities outsource more of their analytical development and testing, while biopharmaceutical companies with internal fill-and-finish capabilities are more likely to outsource lyophilization services.

Many biopharmaceutical companies can accommodate their liquid-fill drug products with internal resources, but they will outsource any lyophilized products. While lyophilization services are used more often by biopharmaceutical companies with internal fill-and-finish capabilities, it is interesting to note that many of the biomanufacturing directors report the need for other stabilization technologies, and their desire to move away from lyophilization. The biomanufacturing directors report that lyophilization is the most frequently used stabilization technology, but it is a finicky procedure and challenging to scale up. Furthermore, biopharmaceutical companies are seeking formulation processes other than lyophilization in order to reduce the cost and problems associated with lyophilization. In addition, certain biopharmaceuticals cannot be stabilized by lyophilization; thereby they need a different stabilization method.

Change in Outsourcing Strategies

Recent economic and industry trends are causing pharmaceutical and biotechnology companies’ managements to review their business practices. From our study, almost half the biomanufacturing directors expect their company’s fill-and-finish outsourcing strategy to change in the near future. The major reasons for the changes in outsource strategy are a) changes in product lifecycle and product mix, b) cost-reduction efforts, and c) risk mitigation. Other reasons given for changing fill-and-finish outsourcing strategies include reasons specific to a particular biopharmaceutical company’s situation; for example, a change in the company’s overall business plans resulting from either a major acquisition or divestiture.

To further explain the changes in product lifecycle and the need for additional fill-and-finish services, one biomanufacturing director notes his company’s strategy. “As demand increases, we will co-invest in a partner. It’s not part of our strategic business plan to build more fill capacity. Our partner will need to build up capacity and have the experience and staff to do the filling. We are still discussing it as we cannot find viral fill. There are some big vaccine companies, but they need 1 million dose runs. We will only need about 50 to 100 thousand dose runs. Even if the big players were interested in our small batches, no one has excess capacity.”

A similar example for more outsourcing as a result of changes in product mix and new products coming on stream is given by another biomanufacturing director, “We started outsourcing a little fill-and-finish. Our strategy will depend on our product mix. We have some new products through acquisitions. As new products come through our pipeline, we will consider whether to use the in-house capacity we have, or if we need new capabilities, we will outsource.”

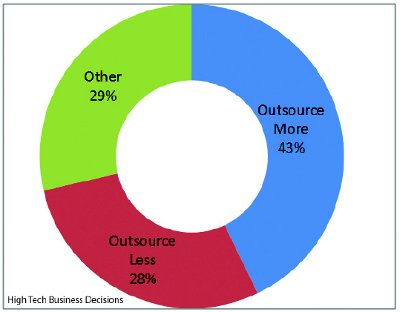

Figure 2 - The Effect from Changes in Outsourcing Strategies

The biomanufacturing directors also discussed how their company’s change in strategy will affect the level of fill-and-finish outsourcing. For the biopharmaceutical companies that are changing their fill-and-finish outsourcing strategy, 43% expect to increase their outsourcing levels, while 28% expect to decrease their outsourcing levels (Figure 2). Of those biopharmaceutical companies that expect to reduce their fill-and-finish outsourcing levels, most of those companies plan to increase their internal fill-and-finish capacity.

Table 1 - Distribution of Fill-and-Finish Capacity by Product Phase

To further analyze the changes in fill-and-finish outsourcing strategies, we segment the biomanufacturing directors’ responses between those directors whose companies have internal fill-and-finish capacity and those directors whose companies do not have internal fill-and-finish capacity. Further analysis of these two segments shows that 80% of the biopharmaceutical companies with internal fill-and-finish capacity have an approved biopharmaceutical, while only 22% of the biopharmaceutical companies without internal fill-and-finish capacity have an approved biopharmaceutical (Table 1).

In analyzing the respondents’ outsourcing plans by segment, 70% of biomanufacturing directors whose companies have internal fill-and-finish production capacity expect to change their outsource strategy in the near future. Conversely, only 37% of the biomanufacturing directors whose companies have no internal fill-and-finish capacity expect to change their outsource strategy. Thus, biotechnology companies with internal fill-and-finish production capabilities are almost twice as likely to change their fill-and-finish outsourcing FINISHstrategies compared to biotechnology companies with no fill-and-finish production capabilities. Using Pearson’s chi-square test for independence indicates a statistically significant difference between these two segments at a p-value of 0.10.

As mentioned previously, slightly more than half the biomanufacturing directors do not plan to change their current outsourcing strategy. For the companies that will not change their fill-and-finish outsourcing plans, 80% of those companies have no in-house fill-and-finish capabilities, and they completely rely on CMOs for their fill-and-finish needs. Of those biomanufacturing directors from companies with no fill-and-finish capacity, one-quarter of those have commercially approved products, while the balance have products now in clinical studies. In summary, these respondents will continue to use CMOs for their fill-and-finish needs.

“We prefer fill-and-finish to be part of the manufacturing because it saves us time and money since we do not have to do additional testing,” notes a biomanufacturing director at a biotechnology company. For those biotechnology companies with products in clinical studies, the change in outsourcing strategy is dependent upon the results of those studies. As reported by a biomanufacturing director, “We don’t expect that to change in the future until we have a partnering event.”

Other biomanufacturing directors note that their company’s strategy is to continue to outsource fill-and-finish production. These biomanufacturing directors report that CMOs have the experience and scale that offer advantages that biotechnology companies cannot achieve by themselves. This sentiment is summed up by a biomanufacturing director, “I doubt our outsourcing strategy will change; we’ll continue to outsource. Most of the classical biotechnology companies don’t have their own fill- and-finish facilities. What I’ve seen is that unless you have many products, fill-and-finish is an underutilized function at biotechnology companies.”

While many of the directors mentioned that their companies will continue their outsourcing strategy, several note that their companies will continue to evaluate new CMOs.

Conclusion

Contract biopharmaceutical fill-and-finish manufacturing companies provide an important service to biopharmaceutical companies. Few biopharmaceutical companies are large enough or have enough fill-and-finish needs to justify building, validating and maintaining internal fill-and-finish capacity. While there is capacity available for routine drug product manufacturing, more unusual drug products requiring special handling are moving through the pipeline. The growth in biopharmaceuticals will fuel the demand for fill-and- finish contract services. Along with this growth, managements at pharmaceutical and biotechnology companies are evaluating their current outsource strategies and are making adjustments to those strategies as a result of technical, economic and regulatory trends.

William Downey, MBA. is president and Helen Nicely, Ph.D. is senior analyst at HighTech Business Decisions, a consulting and market research company. Web: www.hightechdecisions.com. Email: [email protected]. Phone 408- 978-1035.